does tesla model y qualify for federal tax credit

This tax credit begins to phase out once a manufacturer has sold 200000 qualifying vehicles in the US. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

Top Electric Vehicles With The Furthest Range In 2022 Verified Org

Last month Tesla sold its 200000th such vehicle and since.

. Jun 27 2019. Tesla has been selling the Model S Model X and Model 3 for. Electric Vehicles Solar and Energy Storage.

At first glance this credit may sound like a simple. Local and Utility Incentives. Tesla reached this mark in July of 2018 so the 50 credit phase out began in January 2019 and ran through the end of June 2019.

Which I dont understand because I purchased it when it was and couldnt. It was cut in half again to 1875. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

For instance once Tesla sold 200000 vehicles no matter which model it was the credit was phased out. Press question mark to learn the rest of the keyboard shortcuts. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal tax credit.

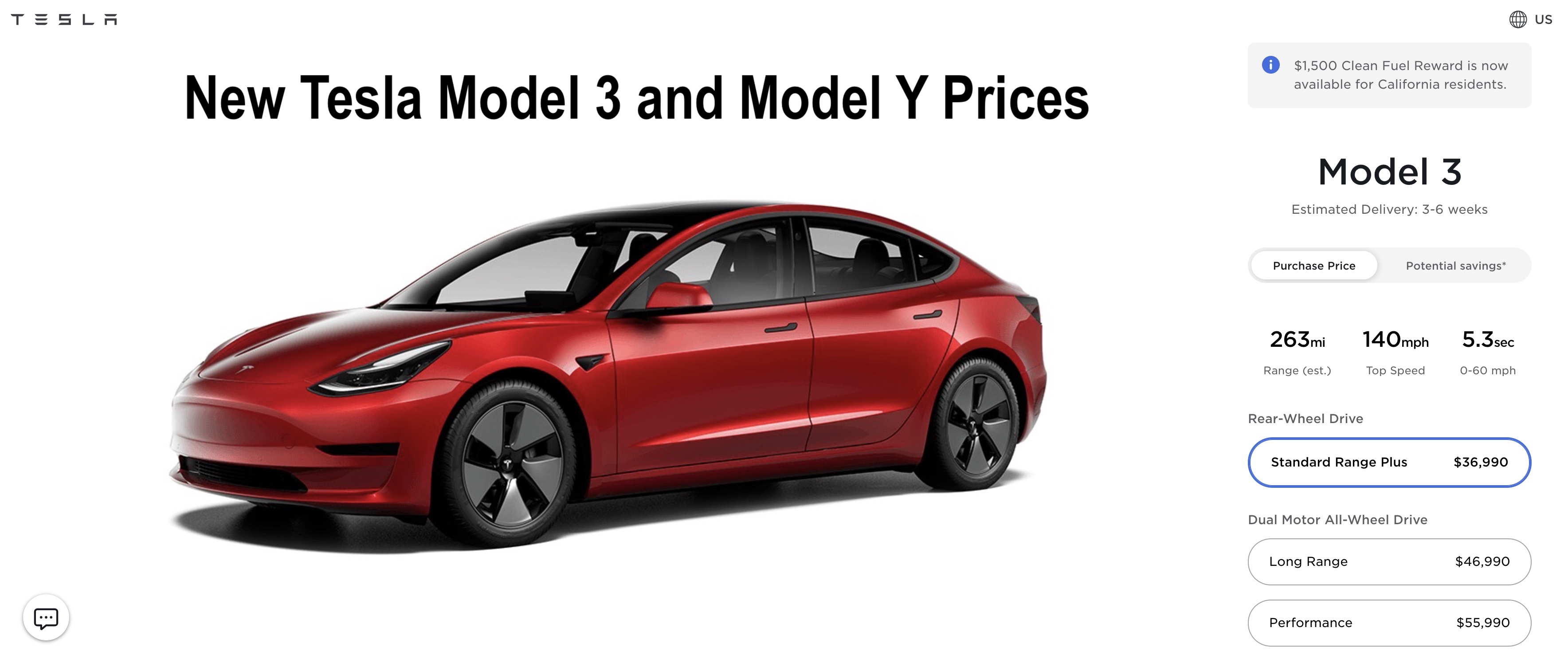

3750 for tax years 2025-26. The Tesla Model Y Long Range went up to 58990 from 57990 and the Tesla Model Y Performance went up to 63990 from 62990. EV Federal Tax Credit for 2021 Tesla.

IR-2018-252 December 14 2018. There is always the possibility that once the Build Back Better Act passes and the new federal tax. Tesla and General Motors are the only manufacturers that have reached the 200000-car milestone meaning new purchases of qualifying vehicles from these manufacturers are not eligible for the electronic car tax credit.

Currently Teslas are not eligible for any federal EV tax credits but they qualify for state tax incentives. First here are some Tesla vehicles that will qualify for the Tax Credit. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

The Tesla Team 10 août 2018. Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and 14000 Pounds or More in the year they are placed in service. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

Tesla Model Y 179 Deduction. All about the Tesla Model Y to complete Teslas S-3-X-Y lineup. All of the Tesla lineup models including the Model S Model X Model 3 and Roadster have exceeded the limit.

Wording says rebate will apply to vehicles. Has sold more than 200000 vehicles eligible for the plug-in electric drive motor vehicle credit during the third quarter of 2018This triggers a phase out of the tax credit available for purchasers of new Tesla plug-in electric vehicles beginning Jan. Initially the tax credit was cut in half from 7500 down to 3750.

I purchased my Tesla Model Y in late Feb. EV tax credit increase to 12500 makes the cut in Bidens Build Back Better framework. Lets hope they approve an extended Federal Tax credit of 7500 for all until a date such as 2024.

Lets find out how this 2021 Tax Credit will benefit Tesla. Press J to jump to the feed. That should be fair sales for US buyers and from all auto manufactures sold in the US.

On the website at the time it said there was still a 2000 Federal tax credit available. Then require only new zero emission autos sold after 2050. Now when I am filing my taxes through TurboTax it says that the credit is no longer available.

WASHINGTON The IRS announced today that Tesla Inc. Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery.

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Bonus add a 5000 Tax credit for Level 5 FSD until. Most likely wont apply to Tesla.

Beginning on January 1 2021. Entry level model S starts at 79690 Model. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

The Tesla Model Y doesnt qualify for the 7500 federal tax credit for electric vehicles because the company has passed the 200000-unit. The 200000 vehicles sold rule applies in total to all qualifying vehicles sold by a manufacturer not just on a model-by-model basis. First here are some Tesla vehicles that will qualify for the Tax Credit.

2022 Tesla Model Y Long Range Awd Pg E Ev Savings Calculator

Tesla Model Y And Model 3 Dominates By Commanding About 2 3 Of Us Ev Market

8 Reasons Why Everyone S Freaking Out About That Tesla 3 Tesla Model S Tesla Motors New Cars

Pin By Education International On Ev In 2022 Cartoon Wallpaper Hd Mustang Sugar Skull Artwork

Tesla Model Tesla Car 2018 Tesla Model 3

Tesla Model 3 Tesla Model Tesla Car 2018 Tesla Model 3

Tesla No Longer Eligible For California Rebate Due To Price Increases

Is House Ev Tax Credit Proposal Targeting Tesla Huge Increase For Unions

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Announces Q2 Deliveries 90650 Electric Cars Beating Expectations Https T Co 0vkscmclkm By Fredericlambert Bjmt Tesla Model Tesla Model S Tesla

Tesla Has Accelerated Its Model Y Delivery Timeline And It S Not Clear Why The Automaker Might Have Managed To Accelerate Prod Tesla Acceleration Tesla Update

Tesla Model 3 Y Axed From Cvrp Rebate After Price Hikes From Inflation Pressure

Official Sales Data Shows Tesla Easily Outsells Toyota Camry So Far In 2022

Tesla Low Income Rebate Off 65

Tesla Model 3 Vs Model Y The Latest Generation Basics Compared Electrek

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

테슬라 모델3 내연기관 판매 금지 가능성 뉴스 커뮤니티 다나와 자동차 Tesla Model Tesla Car Model

Tesla Model S Tesla Model S Electric Cars Electric Sports Car